Mutual Funds

Mutual Funds

Are you looking to secure your financial future, achieve your long-term goals, and build wealth for life's important milestones? At Wealue One, we are committed to helping you navigate the complex world of investments and mutual funds to make your financial dreams a reality.

We Value You!

Our mission at Wealue One is simple yet profound: to empower individuals like you to make informed investment decisions that lead to financial success. Whether you're planning for your children's higher education, their wedding, your retirement, buying a car, going on a dream vacation, or purchasing your dream home, we have tailored solutions for every goal.

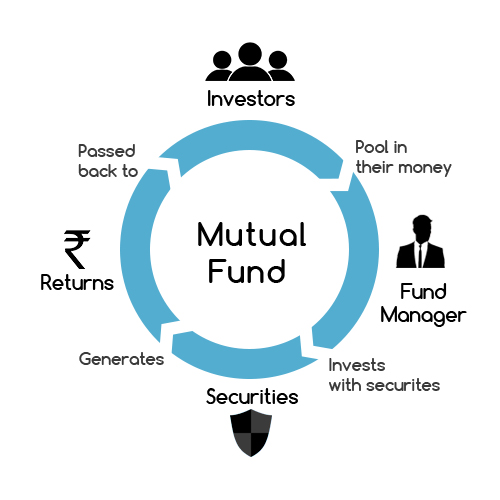

Mutual funds have become a popular choice for long-term investment and retirement planning due to their potential for growth and relatively lower risk compared to investing in individual stocks or bonds.